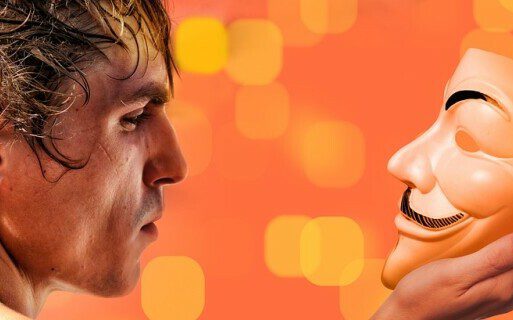

The Psychology Behind Scams takes an inside look at why we get scammed. Scams are deceptive plots designed to swindle us. And they have become a pervasive menace in our digital world.

They prey on optimism, need, or ignorance. This leads individuals to give their money, personal details, or even their sense of security.

In the evolution of this digital age, scams have morphed from the famous Nigerian Prince emails to sophisticated social engineering tactics. The most common methods are through emails, social media, and even texts, emerging as a constant threat.

Understanding the mechanisms of scams is crucial not only for my protection but for yours as well. By dissecting the psychology that underpins these malicious schemes, we arm ourselves with knowledge that is mightier than any firewall.

It’s important to note that scams don’t discriminate; they cast a wide net hoping to catch anyone, even those who consider themselves savvy and aware.

Thus, the quest to understand the psychology behind scams is less about casting shame on those who fall victim and more about building a psychological armor against future attempts.

There are affiliate links in this post. So, if you buy something, I may receive a small paid compensation, at no additional cost to you. These small fees help to cover the costs of bringing this content to you. Thank You For Your Support.

The Psychological Triggers of Scams

Scammers are masters at pulling the right psychological levers to prompt action. They understand that to get inside your wallet, first, they must get inside your head.

One of their tools? The exploitation of universal psychological triggers. These are the instinctive responses we all have that scammers manipulate, often without us even realizing it.

From creating a false sense of connection to presenting too-good-to-be-true opportunities. These tactics are designed to override our logic and provoke emotional reactions.

Trust is a fundamental element in the psychology of scams. It’s deeply rooted in human nature to seek connections and to trust others. Especially, those who appear to share similarities with us.

Scammers fabricate stories and scenarios that resonate on a personal level, making us feel understood and safe. This illusion of a common ground can cloud our judgment and make us more susceptible to deceit.

Vulnerability is another key factor. At times of uncertainty or need, we may find ourselves searching for solutions and support. Scammers exploit this by presenting themselves as the bearers of exactly what we seem to need at our most vulnerable moment.

What’s more, once a scammer senses hesitation, they are adept at reassuring us with fake testimonials or assurances, adding another layer to the facade of trustworthiness.

Cognitive Pitfalls: The Biases Scammers Bet On

Our brains use mental shortcuts to make sense of the world. These are called cognitive biases, and they can lead to errors in thinking, especially under pressure. Scammers are experts at exploiting these biases to their advantage.

Some common cognitive biases include the bandwagon effect, where we do what others are doing. Or confirmation bias, where we favor information that confirms our preexisting beliefs.

A classic example is the ‘commitment and consistency’ bias. Once we commit to something, even in a small way, we’re more likely to go through with it to stay consistent with our self-image.

This is why scammers might ask for something small at first, gradually escalating their demands.

Our own rules-of-thumb are another bias where we judge the likelihood of an event by how easily we can recall similar instances.

Scammers may exploit this by sharing stories of people who have supposedly ‘won’ or ‘earned huge returns’, making us believe that we too could be just as lucky.

One powerful bias is the ‘scarcity principle’. We are wired to desire what’s in short supply. By offering a ‘limited time opportunity’, scammers create a false sense of urgency.

This pushes us to act quickly, without thorough analysis, fearing we might miss out. It is this perceived scarcity that often leads straight into fear and urgency tactics, which I will discuss next.

The Psychology Behind Scams – Fear and Urgency

I’ll take a moment to explore the tactics of creating fear and urgency that scammers frequently use. It’s a psychological one-two punch designed to bypass rational thought and trigger immediate action.

The goal is simple: make you react before you have a chance to think it through.

You’ve likely encountered emails or phone calls pressing you to act swiftly to avoid some dire consequence. This tactic feeds on the fear of loss or punishment.

Scammers know that when humans feel threatened, their instinct is to act fast in self-defense, often without a careful assessment of the situation.

Real-world examples are abundant. A common one is the ‘tax scam call,’ where scammers pretend to be tax officials. They claim you owe money and threaten legal action if you don’t pay immediately. The urgency they create is palpable – pay now or face unimaginable consequences.

The power of these tactics lies in their ability to make victims feel like they don’t have time to consult someone they trust. That isolation is an ally to scammers. Once the panic sets in, the trap is sprung, and rational thinking often goes out the window.

Building on the understanding of these fear and urgency tactics, the next section will dive into how scammers cultivate the illusion of authority.

It’s another psychological illusion that, when combined with the manufactured urgency, can be devastatingly effective.

It seems incomprehensible that intelligent, well-informed individuals can sometimes fall prey to scams. But when a scam appears to come from a position of authority, rational skepticism often gives way to trustful consent. This illusion of authority is a critical component in a scammer’s arsenal.

Authority, real or feigned, carries weight. By mimicking trusted institutions or individuals, scammers can evoke a sense of obligation or compliance.

They may impersonate government officials, bank employees, or even familiar corporate logos and branding to gain credibility.

Scammers are keenly aware of the E-E-A-T principles, albeit for criminal purposes. They fake expertise by crafting detailed narratives or utilizing technical jargon that sounds plausible.

They create the illusion of authority by asserting positions that demand respect. Often as law enforcement or high-ranking executives. Trustworthiness is mimicked through what appears to be a history of reliable information, often bolstered by fake testimonials or spoofed websites.

By understanding that the appearance of authority may be just that – an appearance – individuals can begin to dismantle the scammer’s façade.

Scrutinizing the source of the information and looking beyond the superficial signs of authority are key. A tip here is to seek out independent verification of the claims being made.

A simple phone call or a quick internet search can often illuminate the reality of the situation.

REAL-WORLD EXAMPLES abound where authority is feigned. ‘Your bank’ emails detailing a security breach, pressing you to verify your account immediately or risk closure.

Or calls from ‘the IRS’ alleging unpaid taxes and threatening immediate legal action unless a payment is made now. These strategies leverage authority to create compliance and urgency. The result leads victims seamlessly into the psychological manipulation of social engineering techniques which will be discussed in the next section.

Related: 15 Current Scams And Frauds

Scam-Savvy: Concluding Thoughts on a Persistent Threat

After examining the multi-layered tactics of scams and the manipulative psychology behind them, a clear picture emerges. Scams are complex, often playing on human psychology to deceive and defraud.

From exploiting cognitive biases to creating illusions of authority, these deceptive schemes are designed to prey on trust and trigger irrational decisions.

Yet, with understanding comes empowerment. Recognizing the signs of scams, such as unexpected urgency, questionable authority, or unfamiliar requests, equips us to respond more critically and cautiously.

Adopting a mindset of skepticism, verifying sources, and never acting under pressure are essential practices that can protect you and your assets.

Education and awareness serve as our primary shields against these deceptive practices. By staying informed about the latest scam tactics and understanding how our own minds can be manipulated. we can avoid potential traps.

Moreover, organizations and governments are leveling up their game with proactive measures and stringent regulations to safeguard the public.

In the midst of this landscape, Wealthy Affiliate stands out as a lighthouse, heralding a scam-free environment. This platform not only fosters an online business community but also emphasizes integrity and educates its members on the importance of building legitimate, sustainable online businesses.

Tired of Scams? Try This Instead – Build Your Own Financial Fort

Worried about scammers stealing your financial security and dreams? Imagine building a legitimate online business instead, empowered by real knowledge & support. Just like me, countless others found success at Wealthy Affiliate. And they have a free Starter Membership. No scams, no gimmicks, just proven strategies and a thriving community to guide you every step of the way. Take control of your future – unlock this free week trial and see how Wealthy Affiliate can turn your fears into financial freedom. Why wait? Your future self will thank you.

Free Trial Could Be Ending Soon – Don’t Wait – Try It Today!Remaining vigilant and informed is the key to not only prevent falling victim to scams but also to foster a safer digital space for all. As we navigate an increasingly online world, let’s commit to safeguarding not just ourselves but also our community against the insidious reach of scams. Report scams to consumer.ftc.gov/scams

FAQ’s

| Frequently Asked Questions |

|---|

| What are the key psychological triggers scammers exploit? |

| Scammers leverage universal psychological triggers like the need for connection and presenting too-good-to-be-true opportunities. They manipulate our instincts and emotions, creating a false sense of trust and connection. |

| How do scammers exploit cognitive biases for their advantage? |

| Scammers exploit cognitive biases, such as the bandwagon effect and confirmation bias. They manipulate our mental shortcuts, like the ‘commitment and consistency’ bias, gradually escalating demands to override logical thinking. |

| What role does fear and urgency play in scams? |

| Scammers induce fear and urgency to prompt immediate action. Tactics like threatening legal consequences or claiming limited-time opportunities prey on our instinct to act quickly under pressure, often bypassing rational thought. |

| How does the illusion of authority contribute to scams? |

| The illusion of authority, whether real or feigned, is a potent tool for scammers. By mimicking trusted figures or institutions, they gain credibility. Awareness and verification of sources help dismantle this façade, protecting against deceptive tactics. |

| How can individuals protect themselves from scams? |

| Adopting a skeptical mindset, verifying sources, and avoiding impulsive actions under pressure are crucial. Recognizing signs like unexpected urgency and questionable authority empowers individuals to respond critically, preventing potential traps. |

Thanks for reading! If you have any questions or comments, please leave them below. I will get back to you ASAP. Please stop back soon!

Chas

I am Chas, creator and founder of Help For Scams And Frauds. I started affiliate marketing and earning money online in 2015. And I can tell you, anyone can do this. But, in order to build a business the right way you must have the right training and avoid the get rich quick schemes.

Check out my #1 Recommendation For The Best Online Training in 2024

Hey Chas,

This is such an important and informative article based on scams and how it affects us.

I started looking into online business and online marketing in 2015 and unfortunately I have been scammed quite a bit that has cost me a substantial amount of money, and I kept it all to myself.

Nowadays I know when I am being scammed and I am over the scams I suffered in the past, but at the time it really did affect me. I didn’t go out of the house for about a year and I didn’t see any friends.

I got my finances back in order and I am able to live properly again, but when you get scammed it really does have a major affect on your way of life and your mental health.

I hope the people who read this can learn and be helped by the information you share.

Thank you for sharing and keep up the great work.

All the best,

Tom

Hi Tom,

Thanks for sharing your story! I am glad you have put those scams in your past. I know how painful it can be, I was scammed as well, and I felt sick to my stomach. But, then I got mad about it! I didn’t do anything wrong, they took my money from me! I found wealthy affiliate and started this website to get even. I figured If I couldn’t get my money back I would ruin their business and let everyone know to stay away from them. It worked, they went out of business finally, but not before they scammed many others!

If I can save one person from falling for these scams, then I have accomplished the reason for creating the post.

Thank you for taking the time to comment and please stop back soon!

Chas