The most notorious scams and frauds of all time are something I think should be considered before investing your money.

I’ve seen how the lure of quick riches can blind even the cautious among us. Scams and frauds aren’t just blips on the moral radar; they’re elaborate schemes that shatter lives and erode public trust. They weave a narrative so convincing that even the skeptical find themselves caught in a web of deceit.

But what makes scams so successful? I call it the ‘credibility cloak.’ It’s an illusion woven from bits of truth, trust in societal structures, and the polish of professionalism. The most notorious swindlers didn’t just appear credible; they were the mirror image of the institutions we rely on.

To understand the present, it’s essential to look back. History is thick with tales of financial charlatans who’ve perfected the art of the scam. Browsing through this chronicle of chicanery, I intend to spotlight those scams that have left the deepest marks.

From the classic Ponzi to the grand illusions of corporate fraud – these stories aren’t merely to shock; they’re cautionary tales. They teach us about human nature and the vigilance needed to guard against those who twist it for their gain. With that in mind, let’s set our sights on one of the oldest and most pervasive deceptions: the Ponzi scheme.

There are affiliate links in this post. So, if you buy something, I may receive a small paid compensation, at no additional cost to you. These small fees help to cover the costs of bringing this content to you. Thank You For Your Support.

Ponzi Schemes: The Legacy of Charles Ponzi

I remember my first encounter with the term ‘Ponzi scheme’. It conjured images of complex financial cons designed to dupe the unsuspecting.

The phrase originates from Charles Ponzi, a man who, in the 1920s, promised investors in the United States large profits within a short period.

A Ponzi scheme is financial smoke and mirrors—new investors’ funds pay off old ones, creating a precarious illusion of profit. It’s a financial magic act where the magician uses borrowed rabbits to keep the show going.

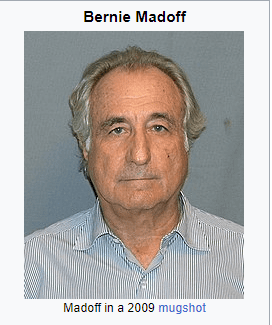

Fast forward to the 21st century, and the name Bernie Madoff became synonymous with Ponzi schemes.

Bernie Madoff, the rockstar of Ponzi schemes! He promised riches in 2008, but it was a financial illusion. When it finally collapsed, it was one of the largest in history, amounting to losses of around $65 billion! Investors were left with empty pockets, and Madoff with a one-way ticket to infamy. His case exemplifies how Ponzi schemes rely on trust, reputation, and the greed that often blinds investors to too-good-to-be-true returns.

Awareness is your PRIMARY shield against such deceits. Look out for investment opportunities offering unusually high returns with little or no risk and pressure to invest quickly. These are classic red flags. Additionally, transparency—or the lack thereof—about how earnings are generated should prompt a deeper examination.

These financial charades rely heavily on the psychological manipulation of investors. The swindlers often exude confidence and wealth, which subconsciously reassures potential investors that their money is in good hands. It’s a dangerous game of emotional and mental influence meant to reassure you while your pockets are being picked.

Understanding the mechanics of a Ponzi scheme is crucial, but it’s even more vital to recognize the methodologies of those pulling the strings. A keen eye and due diligence are critical in ensuring that the line between a legitimate investment and a swindle does not blur. Unless you’re vigilant, you might find yourself entrapped in an alluring web, woven with promises of quick riches and financial freedom.

The Most Notorious Scams And Frauds Corporate Catastrophes: From Enron to WorldCom

Corporate frauds are not merely confined to the smoke-filled back rooms of shady operations. They often unfold behind the glossy facades of some of the most respected institutions.

This section sheds light on how the mighty have fallen, how trust was breached on a colossal scale, and why these examples remain important lessons for both investors and regulators.

Take Enron, for instance. It was once a titan of the energy industry, celebrated for its apparent innovation and sky-high stock prices. Little did the public know, Enron’s success was a mirage.

It was crafted from fabricated financial reports and improper accounting practices. When the Enron scandal broke in the early 2000s, it resulted in billions of dollars of lost shareholder value. It shook the financial world to its core.

The WorldCom Scheme

Similarly, WorldCom made headlines not for connecting people through telecommunications but for an accounting scandal that erased billions in market value. In an attempt to maintain the illusion of profitability, expenses were falsely listed as capital investments, inflating the company’s assets.

As WorldCom’s scheme unraveled, it not only led to the company’s bankruptcy but also to significant reforms in corporate governance and financial disclosures.

Both Enron and WorldCom serve as stark reminders: despite robust markets and the appearance of due diligence, corporate malfeasance can exist on an epic scale. These events ushered in new regulations like the Sarbanes-Oxley Act, aimed to protect investors and restore confidence in the financial system.

Nevertheless, the question remains whether regulations alone can ward off human greed and the temptation for deceit.

In the transition to a digitized economy, scammers have not fallen behind; they’ve merely changed the playing field. The move into the next section explores the sinister evolution of fraud in the cyber age and why digital literacy is as crucial as financial savvy in protecting personal assets.

Cyber Swindles: The Rise of Online Scams

As technology marches forward, it offers incredible opportunities for innovation and connection. However, in its shadow lurks the opportunistic world of online scams, a modern twist on age-old deception. I’ll walk you through the digital terrain that fraudsters navigate and share insights on how to stay one step ahead of their tricks.

Let’s start with a less celebrated ‘Hall of Fame.’ There are key players in the cyber scam arena that have garnered notorious reputations. From phishing emails that masquerade as legitimate business communications, to fake antivirus software that compromises your data rather than protects it, these scams have a common thread: they exploit trust and curiosity.

Among these, the most audacious email scams include the ‘Nigerian Prince’ also known as the ‘Nigerian Letter’ These emails convinced users to transfer money under the guise of helping release mythical fortunes.

The Nigerian Prince scam is a type of advance-fee fraud in which the victim is promised a large sum of money, but is first required to pay a smaller fee in advance.

The scammer typically poses as a Nigerian government official or wealthy businessman, and may use a variety of tactics to convince the victim to send them money. Once the victim sends the money, the scammer disappears and the victim never receives the promised funds.

Related: Nigerian Letter or The “419” Scam

The Most Notorious Scams And Frauds Include Romance And Cryptocurrency Scams

Or consider romance scams, where fraudsters play on emotions to bilk unsuspecting victims out of money. More recent phenomena like cryptocurrency scams have also taken center stage, leveraging the enigma of blockchain to shroud deceitful schemes.

Understanding that the internet is a tool that can be wielded for good or ill is critical. That’s why cybersecurity measures are so essential in the digital age. These include regular updates to digital literacy, employing strong passwords, and a skepticism towards too-good-to-be-true online offers.

A universal tip? When in doubt about the legitimacy of an online request, pause. Verify the source through independent means, and never share personal information until absolutely sure of the other party’s authenticity. By embracing vigilance, we craft a shield against these intrusive swindles.

This vigilance brings us to an undeniably bright spot in the online world—a place where integrity is paramount and learning to build a legitimate business is the reality. We’re transitioning into an era where business education can be both accessible and trustworthy. Wealthy Affiliate embodies this shift. In the next section, I’ll delve into how Wealthy Affiliate stands as a bastion against scams, offering a solid foundation for building your business without the fear of fraud.

Tired of Online Scams? Build a Real Online Income Instead!

Losing hard-earned money to scams is frustrating and scary, especially in today’s digital world. But before you resign yourself to another decade of the 9-5 grind, there’s a way to break free and build a legitimate, sustainable online income.

Remember those “get rich quick” schemes that promised easy money? Forget them. I’m talking about real work, real skills, and real results. That’s exactly what I found with Wealthy Affiliate.

After countless scams and disappointments, I discovered this platform that empowers people like you and me to build thriving online businesses. No credit card needed, just a week of your time to explore their free Starter Membership.

In that week, you’ll learn from experienced entrepreneurs, access top-notch training, and build a supportive community around you. It’s like having your own personal success coach, available 24/7.

Still on the fence? Consider this:

- Free to try: No risk, just the chance to change your life.

- Proven track record: Thousands of success stories from real people.

- Comprehensive training: Learn everything you need to succeed online.

- Supportive community: Connect and share with like-minded individuals.

Don’t let another year slip by. Take control of your future and start building your online income today. Click the link below to access your free Wealthy Affiliate Starter Membership and unlock your potential.

Remember, ten years from now, you could be living the dream. Why wait?

Click here to claim your free Wealthy Affiliate Starter Membership!

Unlock The Free Trial Package Now!

FAQ’s

| Frequently Asked Questions |

|---|

| What defines a Ponzi scheme, and how does it operate? |

| A Ponzi scheme is financial smoke and mirrors—new investors’ funds pay off old ones, creating a precarious illusion of profit. It’s a financial magic act where the magician uses borrowed rabbits to keep the show going. |

| Bernie Madoff – the modern Ponzi mastermind. What unfolded? |

| Bernie Madoff, the rockstar of Ponzi schemes! He promised riches in 2008, but it was a financial illusion. Investors left with empty pockets, and Madoff with a one-way ticket to infamy. |

| Enron and WorldCom – how did corporate giants crumble? |

| Enron and WorldCom, corporate tragedies. It’s like investing in a blockbuster but getting a low-budget flick with accounting errors as main characters. Shareholder value dropped, teaching us to trust but verify. |

| Nigerian Prince emails – what’s the deal? |

| The Nigerian Prince – the unsung hero of email scams. It’s like an invite to a royal ball turning into a trap. Be skeptical of digital Cinderella stories; they usually end with your money disappearing. |

| How to shield against online scams? |

| Build a digital fortress—regular updates to digital literacy, strong passwords, and skepticism toward too-good-to-be-true online offers. When in doubt, pause, verify, and avoid the digital swindler’s trap. |

Thanks for reading. I hope you now have the Information you need on ways to protect yourself. If you have any questions or comments, please leave them below.

Chas

I am Chas, creator and founder of Help For Scams And Frauds. I started affiliate marketing and earning money online in 2015. And I can tell you, anyone can do this. But, in order to build a business the right way you must have the right training and avoid the get rich quick schemes.

Check out my #1 Recommendation For The Best Online Training in 2023

There has to be a willing participant in all scams, and as you say when a person is willing to pay the price with a legitimate opportunity, that person is invulnerable to scams as they know what it takes to succeed. Thanks for these many insights. All the Best. Joseph

Hi Joseph,

You are right, it takes two people for the scam to work. But, I know these scammers are very good at what they do! I have unknowingly gotten myself into a few situations that I thought were actually legit. Turns out they were scammers preying on people. These scams are the worst in history, maybe history will be a guide for all of us!

You are welcome! Thank you for taking the time to comment, and please stop back soon.

Chas

Hey Chas,

Great post. I had heard some of the schemes before, but it was great to learn about some of the history of some of them. So many people still believe it is possible to “get rich quick”. When the reality is that there will always be some effort required if you do want to make money online.

Hi John,

Thank you for the kind words. Yes, these scams are now history, but they were some of the worst in history. I hope that history is a lesson for us all. Getting rich quick is a fantasy, there is no free lunch. Doing affiliate marketing is hard work and requires a lot of effort. But, the rewards compared to a 9-5 are substantial. That is why I mentioned Wealthy Affiliate! They are my #1 recommendation for a good reason. They are legitimate and the real deal.

Thank you for taking the time to leave a comment, please stop back soon!

Chas