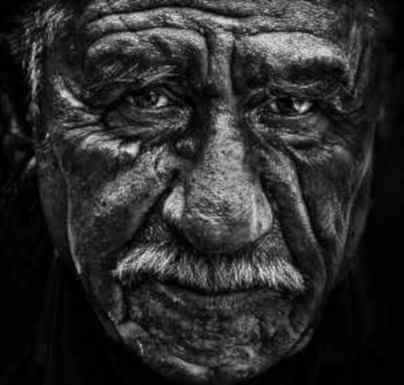

Top Senior Citizen scams take advantage of the age related factors affecting older citizens. Many older adults have disabilities from their advanced age.

Failing memory, poor eyesight, few family members, and poor health make them extremely vulnerable.

Most have their houses paid off, and keep money at home. These reasons make seniors a gold mine to younger, slick talking crooks. let’s take a look at some of the Top Senior Citizen Scams.

Table of Contents

The Top Senior Citizen Scams

- Identity Theft.

- Health Care and Health Insurance Fraud.

- Counterfeit Prescription Drugs.

- Fake Anti-Aging Products.

- Funeral Expenses and Burial Fraud.

- Telemarketing, Internet, and Investment Scams.

- Reverse Mortgage Frauds.

A Top Senior Citizen Scam Is Identity Theft

Nowadays, identity theft is a top senior scam. Seniors are exposed daily by revealing personal information required for their care.

Often, they must go through the power of attorney. One of many problems out of their control. Each and everyday they give medicare card numbers and social security numbers. All these numbers are needed for their stay in hospitals and nursing homes. Giving out this information is exposing their identity daily.

Normally senior citizens have a nest egg. After years of paying a mortgage, they own their own home and have good credit. Consequently, they are an attractive target for thieves. Senior citizens were born and raised in a different era. Back in their day, people were treated with more respect. Everyone was expected to be polite.

As a result, it is harder for them to just hang up on the thieves. Because, it was considered to be rude.

Seniors Fear Mental Incompetence

Seniors worry about relatives learning they got scammed. They feel they might consider them mentally incompetent and place them in a senior care home.

Ultimately, for the seniors, the result would be a loss of freedom and sense of worth.

Tragically, they also have no idea where to report such crimes. Moreover, if they can’t remember well or see clearly, they make poor witnesses to any crime. It can take weeks or even months for older victims to figure out that they have actually been scammed.

Memories fade and description recall of the thief has also faded after that length of time has past. Resourceful thieves know this, and use it to their advantage.

Even with all the medical advances in America, seniors are still susceptible to certain product scams. Products that would claim to be age fighting, or have the ability to enhance cognitive thinking, or virility are enticing. Seeing themselves grow older each passing day, makes a promise of youth returning very powerful.

It is no wonder that they would believe the product claims. America is a country that boasts of medical improvements that have increased everyone’s lifespan. So why not?

Healthcare Fraud Leads Top Senior Citizen Scams

Fraudulent billing for medical equipment, and performing fake tests are common frauds. These promotional tests are often performed at shopping malls, or drug stores. Then, scammers use these test results to create Medicare fraud and other Health Insurance scams.

Another type of fraudulent billing, is for services that were never performed. Medical equipment manufactures also like to target seniors. They offer free equipment, then bill Medicare for a cost reimbursement.

Thieves will fake signatures of doctors ordering unnecessary equipment or services.

Tips On Avoiding Healthcare Fraud

- Do not accept or sign blank insurance forms.

- Never allow automatic billing for services.

- Ask what you out of pocket costs are going to be.

- Call your insurer to get an explanation of benefits.

- Do not deal with providers claiming you service or equipment is free.

- Only give Medicare Identification information to the actual provider of your services.

- Keep all records and doctors orders for any equipment.

- Report health care fraud to National Health Care Anti-Fraud Association or NACAA

Counterfeit Prescription Drug Scams

Seniors will use online pharmacy sites with the lowest prices, trying to save money. But, it isn’t always a good idea.

Far too often, online sites use counterfeit look alike and generic pills.

However, these are often made overseas without FDA approval. They may look similar, but they are not. Many do not contain the same amount of the drug consistently in each pill.

The FDA warns against purchasing from online pharmacies that are not listing a verified seal of legitimacy. Seniors should to use pharmacies that are based in the U.S.

Here are a few tips to help avoid counterfeit prescription drug scams.

- Carefully check the packaging for any tampering. And be sure the prescription numbers match your last purchase.

- Report anything that looks suspicious to your pharmacist or doctor.

- Be suspicious of any new side affects.

- Be sure online pharmacy’s have the Verified Internet Pharmacy Practice Site (VIPPS) seal.

- Cheap pills are cheap for a reason, and it could be that they are counterfeit.

- Report counterfeit pills to the Drug Enforcement Administration-DEA

Fake Anti-Aging Products Scams

Senior citizens despair as their youth vanishes. Unfortunately, aging makes the wrinkles and sagging skin appear.

Soon, that reflection in the mirror becomes a person they don’t recognize anymore.

Understandably, products promising to restore that youth and beauty, are a strong temptation to resist.

Here are some guidelines:

- Be leery of any products making outrageous claims special secret ingredients or formulas.

- Find out the expectations of the product, what it will and won’t do for you.

- Check with consumers agency’s like the better business bureau for complaints on the product.

- Beware of “snake oils” or products that claim to cure everything.

- Do not buy products that claim to replace your doctor.

- You should always check with your doctor before taking any products or supplements.

- Always consider supplements carefully. Supplements are not prescription drugs. The regulations governing supplements are not as strict as prescription drugs.

- You can report adverse event complaints to the U.S. Food and Drug Administration– FDA

Funeral Costs And Burial Fraud

A funeral is a difficult time and does not need to be made more difficult. Don’t put yourself into financial ruin to bury a loved one.

Many times the funeral director adds high priced extras you don’t need.

Unfortunately, they do this by taking advantage of the situation and playing on peoples emotions.

Everybody wants to pamper their loved one, so they purchase extras that are unnecessary. This of course adds to the total costs.

Some Funeral Costs To Consider

Always shop around to get enough information to make an informed decision. Take a friend along to ask their opinions, and make sure you get a list of all costs. It is required by law.

- Caskets vary in cost, so educate yourself and know what you want.

- Compare the funeral homes basic services, to their costs for additional services.

- Remember, caskets and embalming are not required for cremations.

- Have all your wishes and agreements put into writing.

- Read and understand cancellation and portability options for transferring your contract to other funeral homes.

- Be sure you know exactly what you are getting before prepaying for any services.

- Carefully think about your wishes. Do not be pressured into someone else’s wishes.

- Complaints are investigated by the Funeral Directors Board in your state.

- Fraud complaints are investigated by the Federal Bureau of Investigation and Federal Trade Commission.

Telemarketing Investment Scams

Telemarketers are not stupid. It is a well known fact that the elderly are basically home during the day. By understanding their fears and worries about financial security, salesmen exploit the fact they may be lonely.

A simple phone call during the day, is sometimes welcome in a seniors home. However, telemarketers and scammers use these traits to their advantage. They know how to gain the emotional trust of elderly victims.

Sales gimmicks like free prizes, ship tours or vacations, can lure seniors in. Huge discount savings are another magnet for seniors. They are told a convincing story, that empties their wallets and bank accounts. Visit my previous post to read more about telemarketing scams and how to avoid them.

The internet scams everyone, including the elderly. Telemarketers realize the scams will work online as well as on the phone.

Sometimes,using an email, or fake websites, they promote the same age old scams with new twists. Phishing for your account numbers by identity theft is a common trick today. Here are some tips to keep in mind on the internet:

- Always call or send an email to a known address to verify the sender of any email solicitation.

- Check out other websites regarding anyone you are dealing with online.

- Be cautious with special offers, low prices, and pressure to send money today.

- Check warranties and return information.

- Use your credit card online for purchases.

- If it sounds too good to be true, it probably is.

- Don’t believe offers of free prizes, or lotteries you won that you never entered.

- Some malware programs freeze your computer and demand payment for fines. Report the scam to IC3 division of the FBI. Do not send any payments to any emails that demand it.

Investment Scams And Ponzi Schemes

The investments offering the highest returns are scams. Usually, they offer high returns that are just too good to be true.

Another selling point, is these risky investments gain extraordinarily high profits in a short period of time. One type of risky product is the High Yield Investment Program or HYIP’s. But, tragically they are often just fake scams

Frequently, these risky investments are Ponzi schemes. This is the worst kind of investment scheme, using new money to support the scheme.

The Ponzi scheme works for awhile, until money stops coming in. The sales pitch of fast high returns in days or weeks, is just hype.

Always check with the North American Securities Administrators Association or NASAA, to be sure you are investing in a legitimate investment. Here is a few tips on investing:

- Beware of high returns and short terms, daily or weekly.

- Avoid investments that offer sketchy details.

- Do not invest in an E-currency account – They are not licensed to transmit money.

- Protect yourself and check things out.

- Do your homework and do not blindly trust friends recommending investments.

- Stay away from international investments, they are impossible to get your money back.

- File complaints with the U.S Securities and Exchange Commission.

Reverse Mortgage Scams

Today, reverse mortgages have become more popular. Along with the popularity, mortgage frauds had increased as well.

Most people recognize the legitimate reverse mortgage as the home equity conversion mortgage or HECV. This is a loan on the equity in the home, that provides monthly income over a period on time. This is the normal legitimate loan.

But, the reverse mortgage scam steals the home from the unsuspecting senior citizen. Often, unscrupulous lenders give loans that steal the legal rights from the senior citizens involved.

Fraudulent lenders, tell the senior citizen their home mortgage is in default. And their only option is a reverse mortgage loan.

Ultimately, the victims don’t qualify for the reverse mortgage. This forces them to purchase a conventional mortgage. Then, during the process, the crook transfers the property to himself and steals the home.

Tips To Protect Yourself From Fraud

- Beware of all reverse mortgage advertisements that you did not contact yourself.

- If someone tells you that you can own a home with no down payment. Don’t believe it.

- Make sure you understand completely what you are signing.

- Don’t accept any payments for property that you don’t own.

- Shop for a reverse mortgage broker yourself. Ask plenty of questions and check them out.

- Check the Housing and Urban Development Website (HUD)for lenders approved by the Federal Housing Administration.

- You can file a complaint with HUD-Office of Inspector General.

Read More About Scams and Frauds Here

I hope you find this information useful and informative.If you have any questions, or comments please leave it below.

Chas

Covid 19 has ravaged the world causing the death of tens of thousands compromised family members and tens of millions of people worldwide. Millions of people in the USA have been thrown out of work do to no fault of their own. This has caused workers to rely on temporary state aid, and forced many from their homes. Something like this is how your life can be turned upside down in an instant. It doesn’t have to be that way

This stark reality is why creating your own business is so important now more than ever. Affiliate Marketing is something that cannot be taken away. Online business is thriving because people are shopping online more than ever!

There has never been a better time to cash in on this lucrative business and create your own financial Independence with online marketing.

Be your own boss, start your journey to financial freedom today.

I am Chas, creator and founder of Help For Scams And Frauds. I started affiliate marketing and earning money online in 2015. And I can tell you, anyone can do this. But, in order to build a business the right way you must have the right training and avoid the get rich quick schemes.

Check out my #1 Recommendation For The Best Online Training in 2024