14 day Payday loans always sound nice in the ads. They won’t bother you till your next payday, and you can have the money until then, no questions asked. It is a short term loan, and the cost is much higher. It must be an effective argument, about 7 billion annually is generated through fees charged by 14 day payday loans. And it is reported that 12 million people use payday loans each year.

Are 14 Day Payday Loans Too Easy To Get?

It is not hard at all to get a 14 day Payday Loan? For one thing, no credit check is necessary. People with bad credit, or no credit cards have a place to borrow money. If you have a car repair that needs done now, you have access to funds you wouldn’t normally have. They are good for an expense that is temporary, or an emergency type situation. As long as you can pay it back on time.

You borrow $300 for 14 days and agree to repay a certain amount of interest about $15 to $20 for each $100 you borrow. BUT, if you don’t repay the loan in 14 days, then it quickly gets very expensive. If you just pay the fees, you can push the loan ahead for another 2 weeks.

14 Day Payday Loans – The Real Cost

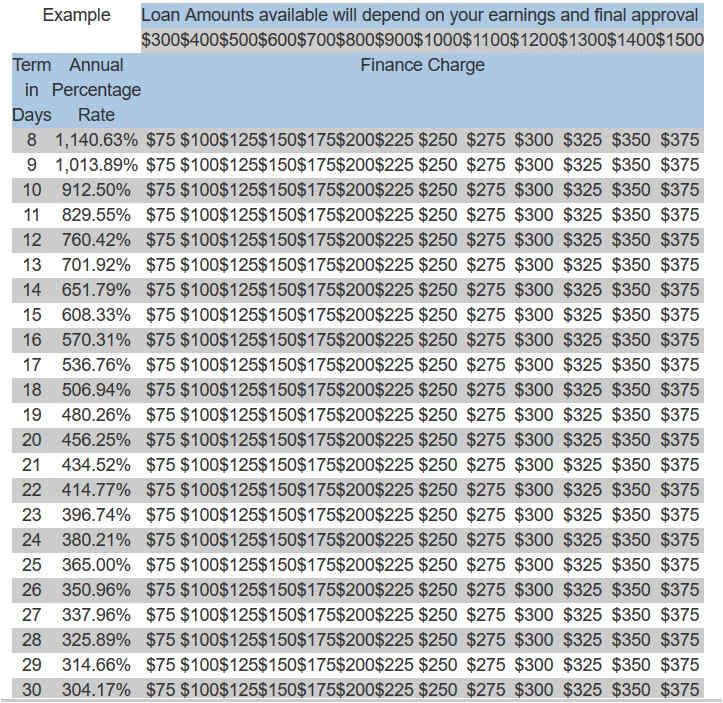

Here is an example of fees charged by typical payday lenders.

(14 day minimum)

Why Do People Continue To Use 14 Day Payday Loans

If people need money quick, then, a payday loan is quick. It’s easy and does not take a lot of paper work. All you really need is a bank account and a source of income and some identification.You don’t have to worry about paying it back until you get your next paycheck, or what ever term you choose.

The problems arise when the loan becomes due and borrowers can’t afford the high payment terms? That is where people get into trouble. It is also where payday loan people make a fortune!

When people can’t repay the loan quickly in the time limit they agreed upon, they are charged huge fees. The borrower often can’t afford the big payment, so he refinances the loan again and pays the interest fee again and is charged additional fees. This is very different from a traditional installment loan, where you pay the debt over months or even years.

People quickly get stuck in a costly cycle of refinancing for a longer period of time.If you can’t get a bank loan or you have no savings and you need money, what choice do you have? That is exactly how they suck the borrower in.

The 14 Day Payday Loans Trap

People would borrow a few hundred dollars and by the time they refinanced it a few times, they owed thousands of dollars requiring payments they could not afford. Payday lenders were more than willing to refinance these loans at these ridiculous rates! The sad fact is that 70% of the people who use payday loans are using them to cover basic living costs.

Here Is a table showing the common interest rate charged:

This Was Outlawed Years Ago

This kind of interest is something a loan shark would do! In fact, payday loans are considered a form of predatory lending. Not so many years ago charging high interest rates was illegal! In fact, before 1970, 18% interest was outrageous! Now 28% percent is common. Some credit cards start at 19.9% and charge 28% if you are late on a payment and apply $25 fees and monthly charges! These fees are steadily climbing and have reached $50 or more.

The Consumer Financial Protection Bureau Upholds High Payday Loan Rates

The Consumer Financial Protection Bureau (CFPB) was created by Congress and President Obama when the signed the Dodd-Frank Wall Street Reform and Consumer Protection Act. This happened in July 2010, and it supposedly established an agency for the protection of consumers. Abusive, deceitful and unfair lenders were to be held to higher standards. So what happened?

The CFPB was also given the power to create new regulations when they were created. They have proposed new regulations on payday loan lenders. The purpose is to make the loans safer and end the vicious cycle of getting consumers caught in paying back tens of thousands more than they originally borrowed.

The biggest problem with the CFPB is that they are subject to oversight by other federal regulatory agencies. The Financial Stability Oversight Council has veto power over any regulations that the CFPB might consider necessary. So, it is a protection agency, without teeth.

In fact if they are harming small business, their regulations would be considered too restricting! I would think these payday loan sharks would fall into the small business category, so just veto any laws that try to curb this activity, right? Just follow the same unethical behavior that got us here in the first place.

South Dakota Uncapped Interest Rate And Created The Problem

When did lenders get the freedom to charge whatever interest rate they want to charge? Well, back in the 80’s, South Dakota, removed the cap on the interest rate, and saved Citibank. 3000 jobs were created in South Dakota, and Delaware soon followed. Credit Card companies flocked to both states. This allowed them to sell high interest credit cards to other states.

Now, they could charge 25% on their Credit Cards, even in states whose usury laws had caps on interest rates. It was the start of the outrageous uncapped interest rate boom that continues to this day. Rates appeared at 25% and 30%, and fees for late payments went from $5 to $15 and as high as $39. The Credit CARD Act of 2009, capped late fees at $27, but only for first time offenders. If you miss a second billing cycle, it jumps to $37. Each fee get added to your payment, and eventually a penalty increase hits the credit card APR.

The law is simple nowadays, if it is on the credit card and you agree to the terms, it is legal.This has caused credit card debt to soar to over $850 billion dollars in the U.S. In 1978 it was $48 billion.

Will Regulations Help

It is a start but it is not the answer. The regulations are coming under fire because they will hurt the Payday loan industry. However, 75% of adult Americans dislike Payday lenders. But, they are still being defended by politicians.

- Ensure people have the income to repay the loan on time.

- Credit checks to determine if the loan is affordable.

- Limits collection attempts on checking accounts.

- limit the number of times the loans can be refinanced.

What is the answer? Do not use Payday lenders! It is a choice we make, so it is our fault in the end. What can we do to avoid using payday lenders. If you have an emergency, try other methods first.

Things You Can Do Instead Of 14 Day Payday Loans

- Borrow from friends or relatives- (Interest free loan)

- Pay the late fee of a late payment

- Credit card cash advance- will cost you more, but cheaper than payday loan

- Use a zero percent credit card offer with no balance, and pay it off within offer limits

- Add to a credit card and increase your payment amount to pay it off

- Pay minimum payments until you get caught up, but do not use minimum payments for extended periods.

- Find credit counseling programs to consolidate debt and extend payment options.

How to Get Help with a Payday Loan You Have

To find help if you are involved in a payday loan, check out the CFPB website. It is a good place to start. You can get good information about payday loans, and submit a complaint as well.

Talk to them first, before you get involved with other types of payday loan consolidations. Other types of government financing may be available as well.

Many offered loans might be a slightly higher interest rate, but it is surely a much better deal than payday lenders.

Some payday loan consolidations are nothing but scams themselves. So, be careful and check them out!

Government assistance for loans can also be found at govloans.gov/

You can also find links there to the Federal Trade Commission FTC and other help agencies.

Everyone needs to understand that these quick loans and the relief for them as well are traps. They are predatory loans that cause extreme financial hardship to everyone. People need to exhaust every possible avenue for short term cash and avoid these loans at all costs.There is help available, so take the time to look around.

Chas

Find out how to avoid scams and make money doing something you love to do. Start with my #1 Recommendation.

Be You Own Boss

Covid 19 has ravaged the world causing the death of tens of thousands compromised family members and tens of millions of people worldwide. Millions of people in the USA have been thrown out of work do to no fault of their own. This has caused workers to rely on temporary state aid, and forced many from their homes. Something like this is how your life can be turned upside down in an instant. It doesn’t have to be that way

This stark reality is why creating your own business is so important now more than ever. Affiliate Marketing is something that cannot be taken away. Online business is thriving because people are shopping online more than ever!

There has never been a better time to cash in on this lucrative business and create your own financial Independence with online marketing.

Be your own boss, start your journey to financial freedom today.

I am Chas, creator and founder of Help For Scams And Frauds. I started affiliate marketing and earning money online in 2015. And I can tell you, anyone can do this. But, in order to build a business the right way you must have the right training and avoid the get rich quick schemes.

Check out my #1 Recommendation For The Best Online Training in 2024

Wow! I didn’t know that it amounted to that much. What a rip off! This is almost like legal loan sharks. I never had to borrow from these guys so I did not know how much interest they charge The best thing about this very well written article is the fact that even a credit card is a better solution than these kinds of loans. Hopefully, your article will get people to think twice before borrowing from them!

Hi Denis,

Yes, they are incredibly expensive!. Why anyone would do this, or get into a situation where they think this will work is tragic indeed. I would think that if they had a credit card, they would not be as desperate as to need the loan. I hope the article helps to make peopl more aware. Thanks for the comment, Denis.

Chas

Thanks so much for this educative review. It will go a long way to enlighten so many people who are unaware of the exact way these 14-day Payday Loans actually operate. Many people fall victims because they feel insecure asking friends for loans (best loans so far), followed by the Government loans.

I expect nothing good from the Payday loan guys as they are businesses set out to make profit, and they won’t stop at anything to maximise their profits, even at the detriment of others.

HI Muhiyb,

You are welcome. You are correct, most people do not know how awful these loans are. Sometimes family and friends can’t help, and sadly they fall victims to this tragedy. It is true, they have no soul. Thanks for leaving a comment.

Chas

Very informative article! It was easy to understand minus some grammatical errors. I enjoyed how you gave solutions to help avoid and get out of debt due to these types of loans. Do you feel your suggestions can be applied towards debt by other loan or credit lender? I’m dealing with debt from personal loans and credit card debt 🙁

Hi Sherry,

Thanks for the kind words, I am glad my article was useful. I will have to check my grammar! Anything anyone can do to avoid these loans is much better than getting a payday loan in the first place! They are nasty! I think getting a loan like this to pay another loan is insane! That is the worst thing you could possibly do! But, if someone was to do that, I would think the cash loan is the best bet. Thanks for leaving a comment.

Chas

This very sad when people start paying so much money for very few dollars it unethical to say the least 14days payday loans is a scum but one regulated by either the state or federal government hence the blatant way of over charged loans.unless people learn to manage their finances or find away of earning extra income apart from main source 14 days payday will remain to a menace in their lives and the shall never get out vicious cycle of borrowing.

Hi Charles,

It is sad that people do this, but as you say even worse when the government gives them it’s blessing! Some people use these on a regular basis and just spiral deeper into debt. Thanks for leaving a comment,Charles.

Chas

Thank you for taking your time to write about this 14 Day Payday Loan. When it comes to credit it is very tricky, we can benefit from it if we use it the right way or it can turn out into a disaster. I think not everyone has the financial literacy. It is something that you have to learn through time and not everyone is good at it. I used to listen to this guy called Dave Ramsey, and he inspired me to get rid of all my cc debts. Will share your post to all my friends who still have cc debts.

Hi Nuttanee,

You are welcome, and thank you for your kind words. This loan is a disaster! Yes, people should be more educated about finances for sure! I think it should be taught in school. Thank you for sharing my post and leaving a comment, Nuttanee.

Chas

14 day payday loan? never heard of that. It does not sound good. This is like setting a trap you know fully well that someone will fall into. How do I start one for 30day payday loan without change in interest rate? It is also risked for the lender because since the person does not have to have good credit and not much documents, if the person decided not to pay, it could be hard to recover the money. Thanks for sharing very informative and eye opener.

Hi GinaO,

They are traps, similar to pawn shops but much worse. If you look at the chart in the article, they have a set interest fee for thirty days at $375 for borrowing $1500. You can see it is almost a quarter of the amount you borrowed. But it gets much more nasty if you don’t pay in thirty days! Most of these people do not have good credit! But, what happens is most don’t pay when they become due, and then they need another loan for much more money, to pay the fees and late costs added. I am sure they have to put up substantial collateral before they get the loan.Thanks for stopping by and taking the time to leave a comment.

Chas

Payday loaners are thought of as the scavengers of the saving money industry. Numerous individuals trust that these organizations simply exploit low salary families and hurt them more than they support them but you can’t blame the borrowers because even family and friends will not offer help to you, most people are very self-centered this days.

Hi Favour,

yes, they are the lowest of the low. This business is so lucrative with the money they charge, most turn a blind eye on the suffering they cause. Families today are in a hard spot, everything is taking every dime working families have. Thanks for leaving a comment.

Chas

This reminds me of my recent experience with borrowing money. I borrowed for a different reason, which is for business use, but the scheme was the same. Since it was a short term loan, the fees were enormous. From processing fees to monthly interest, you can’t help but nauseate. I was only able to kick the problem out when I started an online business that brings in profits, so with your #1 recommendation, I think people are in for a better route.

For the loan sharks, I don’t think the Heavens will approve your schemes. Yes, sometimes they can get away with their bad practices, but sooner or later, those practices will boomerang to them. It’s immoral and a form of oppression, exploiting the needy.

Hi Gomer,

I hope that I never have to borrow from these crooks in my life!I hope you paid them back in plenty of time to avoid the nasty late fees. Yes, people would do much better with my #1 recommendation, than to ever borrow from these guys! I hope they answer to GOD on the final day. Thanks for leaving a comment, Gomer!

Chas

Hi Admin! This is a rip off. However people don’t have choice when they urgently need cash. I cant imagine paying an interest between $15 to $30 for each $100 borrowed for only 14 days. You are definitely right by suggesting that people should borrow from friends or relatives, that alone is a better option than having to deal with unrealistic payment of interest. The consequences of not paying the loan as at when due is even more embarrassing.Thanks for your review on Payday loan, anybody that finished reading this article will know exactly the consequences of getting involved with Payday loans.

Hi Gracen,

Yes it absolutely is! It is a total trap! Everybody must stay away and never, never get a payday loan! But it is fantastic business for all loan companies, because consolidation loans for bad payday loans is big business! Thanks for leaving a comment!

Chas

Thanks for sharing this informative and educative article. In my own view fast loan like this will end up causing people financial hardship because the interest will be unbearable(too much) and I think limited time will be given to the lendee to refund the money . I really won’t advice anyone to go into this.

Hi Lok,

I am glad you liked the article. These loans are legit, but should be outlawed.What happens most of the time is people can’t pay on time. So, the lenders make big money off the people who can least afford this scheme. Then they get trapped and when they can pay, they need a bigger loan to pay-off the enormous debt. Thanks for leaving a comment.

Chas